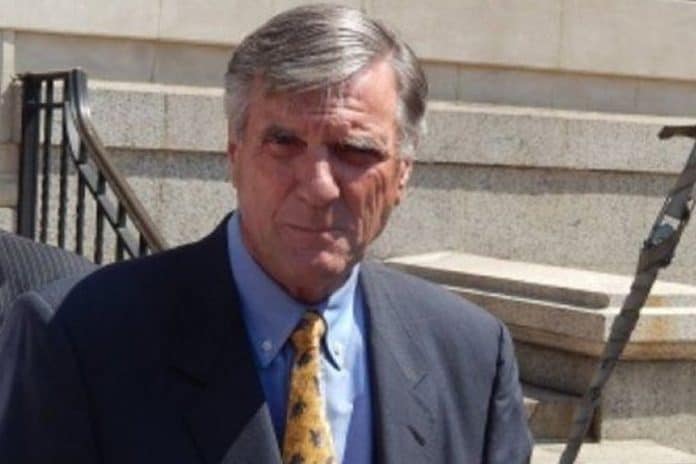

TOMS RIVER – County Republican Chairman George Gilmore resigned from the GOPAC political action committee amid his convictions in charges related to tax evasion.

According to its website, GOPAC is a political action committee organized in 1978 that raises funds for Republican campaigns and educates candidates on the best practices in winning an election.

“George Gilmore was a member of the GOPAC Board of Directors until April 2019 when he submitted his resignation,” replied Jessica Curtis, executive director of GOPAC. “We appreciate his counsel and efforts to help advance our mission during his tenure.”

A 2014 article by NJ.com revealed thousands of dollars of donations going into GOPAC from contractors who in turn won millions of dollars in jobs from municipalities. It is illegal for a contractor to win a job from a candidate who they donated to, but there is no law against a contractor donating to a political action committee which then donates to a candidate. According to this article, Gilmore became the state chairman for GOPAC in 2010, the same year Chris Christie took office. Immediately, donations increased under his tenure, although Gilmore said in that article that donors have no say in where their donations go.

The Charges

George Gilmore, 70, of Toms River, was found guilty of one charge of making false statements on a 2015 loan application submitted to Ocean First Bank, and two charges of failing to collect, account for, and pay over payroll taxes withheld from employees for two quarters in 2016. These are related to his law firm of Gilmore & Monahan. This firm does work with many municipalities, including Berkeley, Manchester, and Lacey.

A press release from the U.S. Attorney’s office detailed the charges. As a partner and shareholder at Gilmore & Monahan, he was in control of the law firm’s financials. For tax quarters ending March 31, 2016 and June 30, 2016, the firm withheld tax payments from its employees’ checks, but Gilmore did not pay them in full to the IRS.

Regarding the loan application, he applied for a Uniform Residential Loan Application (URLA) to obtain refinancing of a mortgage loan for $1.5 million with a “cash out” provision that provided Gilmore would obtain cash from the loan on Nov. 21, 2014. On Jan. 22, 2015, he updated the application, failing to disclose outstanding 2013 tax liabilities and personal loans he got from other people. He had received $572,000 from the cash out portion of the loan.

The jury was not able to reach a decision on the charge of tax evasion for years 2013, 2014, and 2015, the court spokesman said. He was acquitted of two charges of filing false tax returns for calendar years 2013 and 2014.

The sentencing date will be July 23. The two counts of failing to collect, account for, and pay over payroll taxes each carry a maximum penalty of five years in prison, and a $250,000 fine, or twice the gross gain or loss from the offense. The count of loan application fraud carries a maximum penalty of 30 years in prison and a $1 million fine.

He had been accused of evading more than $1 million in taxes. Meanwhile, he had been spending a great deal on home remodeling and lavish decorations, reportedly such things as a mammoth tusk and a statue of George Washington.

His attorney, Kevin Marino, had said that these purchases were due to a hoarding disorder, and even retained a psychological expert to testify about it. However, the federal government did not want to hear that testimony. Marino has stated that he will attempt to overturn the convictions.