BRICK – It was a scene that has become familiar at the shore over the past six years: residents crowded into a room asking officials for answers and help in fixing their flooded homes.

Only these weren’t Superstorm Sandy survivors; they were mostly residents of Greenbriar 1 who attended a storm symposium at their clubhouse on Wednesday morning after 114 homes were flooded there during an Aug. 13 storm that dumped some eight inches of rain in two and a half hours.

The township police department called for the meeting to help the victims not to be “victimized twice,” by employing fraudulent contractors to repair their homes, said Police Chief James Riccio, who gave opening remarks to the full room.

“It’s unfortunate we have to be here under these circumstances, but we want to share what we’ve learned after going through it during Sandy,” Riccio said. “A disaster like this brings out the best in people and it brings out the worst in people.”

Nearly 20 officials were seated at the front of the room, which included representatives from Governor Phil Murphy’s office, various departments from Ocean County, the State Police, Brick Police Department and non-profit groups.

Brick Detective Michael Bevacqua, who specializes in fraud investigations, said that contractors would have to sign in at the Greenbriar Clubhouse before they could work on anyone’s home in the age-restricted community.

“The Brick Police Department will have a zero tolerance for fraudulent contractors,” he said. “We’re gonna be out there.”

Everyone is in a rush to get their homes fixed, but good contractors are not usually available the very next day, Bevacqua said.

While hiring a contractor, he warned the audience to have a contract with a start/end date, and said that a reputable contractor would not ask for big deposits upfront.

“They might just want some money for materials, and pay by check,” he said.

For example, $500 upfront would not be out of order for phase 1, sheetrock installation; another deposit for phase 2 electrical work could be expected; and residents could expect to pay the final amount during phase 3 when the work is completed, Bevacqua said.

“There’s nothing we can do about the quality of work, for a contractor who does crap work,” he said. “Some Sandy ‘contractors’ became ‘contractors’ the next day because they knew there was money.”

Dan Kelly from the Governor’s office said his office wants to partner with local organizations to “provide any services we can.”

He said that the flooding was not a “hurricane-level event” from the standpoint of victims receiving federal assistance.

Kelly warned that it would be “an uphill climb” for any of the residents to obtain federal grant money, but urged flood victims to hold on to their documentation, receipts, photos and invoices and to treat their damaged homes as if they would be filing an insurance claim.

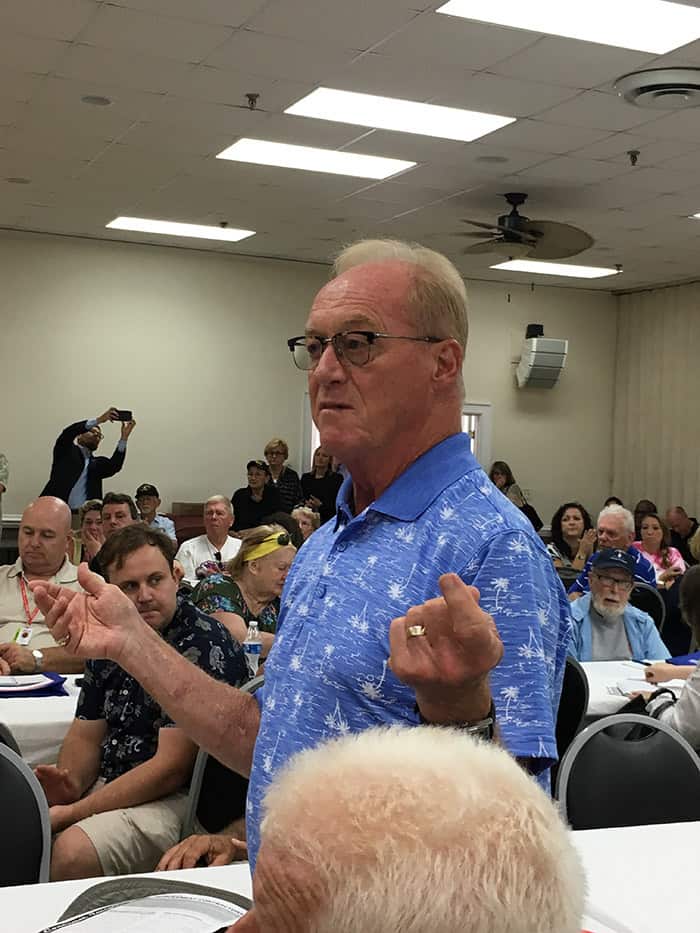

Before the officials could finish introducing themselves, some of the residents started shouting questions from the audience.

Greenbriar resident Kevin Smith said their homeowner’s insurance policies should be responsible for paying for the flood damage.

“This community is 50 years old and it’s never happened before,” he said. “If the insurance companies felt it should be in our best interest to have flood insurance, even though we’re not in a flood zone, I wasn’t advised to get flood insurance. It’s doubletalk,” he said.

He said the residents need resources to get back on their feet.

“What if this happens again? Can you even fathom that we spend $60,000- $70,000 to put our houses back together again only for it to happen again? We want the Parkway investigated,” Smith said to audience applause.

Smith was referring to the recent $21 million Garden State Parkway reconfiguration that some residents are blaming for their flooding problems.

Ed McBride from the Ocean County Department of Community Affairs said that going forward, residents might want to buy flood insurance.

“Flood insurance is provided by the federal government in the (National Flood Insurance) program,” he said. “I know it doesn’t help now but if it happens again you’ll have coverage.”

Chief Riccio said that the symposium was limited to how to get rebuilt and not about what caused the flood.

“That meeting needs to happen, but we’re giving you information so you don’t become a victim again,” he said.

Holly Basile came to the symposium on behalf of her mother, Greenbriar resident Peggy Smith, 85.

“We had the sheetrock pulled out – what is our next step? What permits do we need? What steps do we need to take to get flood insurance?” she asked.

Basile said her mother’s electric meter was removed and was told it would cost $185 for a permit to replace it until she “made a stink” and the fee was waived. “Permitting needs to be addressed immediately,” she said.

Kathleen Conway from Sutton Village said she and her flooded neighbors hadn’t received any help, “not even a bottle of water.”

Twelve homes were flooded in her neighborhood, and two are unlivable, including her own, she said.

Greenbriar resident Robert Ferris, 87 and his daughter Jean said they had several inches of water in their home.

“The symposium was interesting, but the residents didn’t know what to expect today. I think they expected more,” Jean said.

They had a contractor come in and gut about four feet of their walls down to the studs. Ferris said he is paying for the repairs out of pocket and is staying in a friend’s summer home until the repairs are complete.