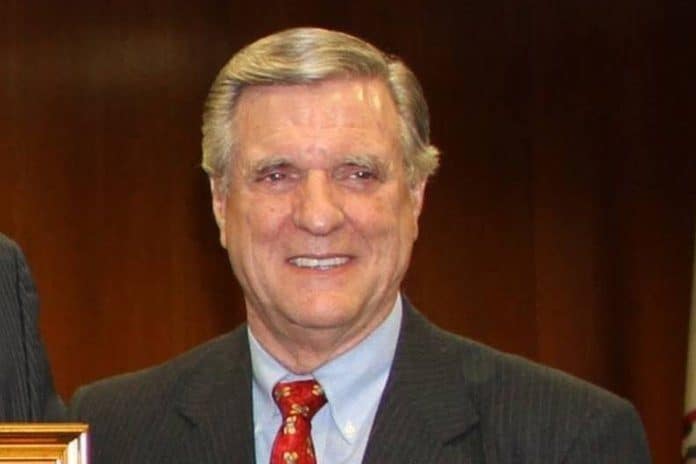

TOMS RIVER – A federal appeals court upheld the conviction of former Ocean County Republican Chairman George Gilmore, deciding that the influential lawyer should go to jail for his financial crimes.

Gilmore, 71, of Toms River, was convicted of not paying federal income tax and lying on a loan application. During the appeal handled by his attorney, Kevin Marino, he alleged that the trial did not include expert psychiatric testimony regarding his claim of having a hoarding disorder that made him spend lavishly on personal expenses rather than pay his taxes.

In the non-precedential ruling written by Judge Thomas Hardiman for a three-judge panel of the U.S. Court of Appeals for the Third Circuit, the court rejected four separate claims raised by Gilmore. It agreed with the government that the trial judge properly excluded the psychiatric expert. Gilmore contended that testimony would have negated his intent to commit the charged tax crimes. The court also rejected Gilmore’s challenges to the jury instructions and sufficiency of evidence.

He had a sentencing hearing on January 22. There, he was sentenced to a year and a day in Fort Dix Federal Correctional Institution. He had also been sentenced to three years of probation after that.

The sentencing judge did not fine Gilmore for any of his offenses, but said he would end up paying “about a million a year” in contract penalties.

The sentencing judge did order mental health treatment.

Gilmore’s law firm did work for a number of towns, which dissolved their contracts with him after his arrest. He also had to step down from being chairman of the county Republicans. Frank Holman took his place, but he is reportedly still very influential in local politics. In fact, several sources stated that he persuaded local Republicans to back David Richter in the 3rd District Congressional race. Richter ultimately lost to incumbent Andy Kim.

In January of 2020, a property apparently owned by him still had some items in storage. The property was at 1591 Route 37/60 Northhampton Unit 5. The phone number on the outside of the building was 732-240-6000, which used to be Gilmore & Monahan’s office number. Visible through the windows were shrink-wrapped furniture and display cases. There was also a file cabinet visible from the door. It was labeled “tax appeals” from towns such as Lacey, Little Egg Harbor, Stafford, and Lavallette. There was one drawer marked “States Industries” and another “Larry’s Files.” It is unknown if it was empty or full of documents.

A press release from the U.S. Attorney’s office detailed the charges. As a partner and shareholder at Gilmore & Monahan, he was in control of the law firm’s financials. This firm has since closed and his partner and employees were not charged. For tax quarters ending March 31, 2016 and June 30, 2016, the firm withheld tax payments from its employees’ checks, but Gilmore did not pay them in full to the IRS.

Additionally, he applied for a Uniform Residential Loan Application (URLA) to obtain refinancing of a mortgage loan for $1.5 million with a “cash out” provision that provided Gilmore would obtain cash from the loan on Nov. 21, 2014. On Jan. 22, 2015, he updated the application, failing to disclose outstanding 2013 tax liabilities and personal loans he got from other people. He had received $572,000 from the cash out portion of the loan.

The jury was not able to reach a decision on the charge of tax evasion for years 2013, 2014, and 2015, the court spokesman said. He was acquitted of two charges of filing false tax returns for calendar years 2013 and 2014.

The two counts of failing to collect, account for, and pay over payroll taxes each carry a maximum penalty of five years in prison, and a $250,000 fine, or twice the gross gain or loss from the offense. The count of loan application fraud carries a maximum penalty of 30 years in prison and a $1 million fine.

Instead of paying taxes, he had been spending a great deal on home remodeling and lavish decorations, reportedly on such things as a mammoth tusk and a statue of George Washington.