LACEY – School District Business Administrator/Secretary Patrick S. DeGeorge made a presentation before the Board of Education concerning the district’s tentative school budget recently.

The current spending plan will cost the average home in Lacey township an increase of $72.99 in property taxes. The value of the average home in Lacey is around $281,000.

The school tax rate for 2021 is 1.0369.

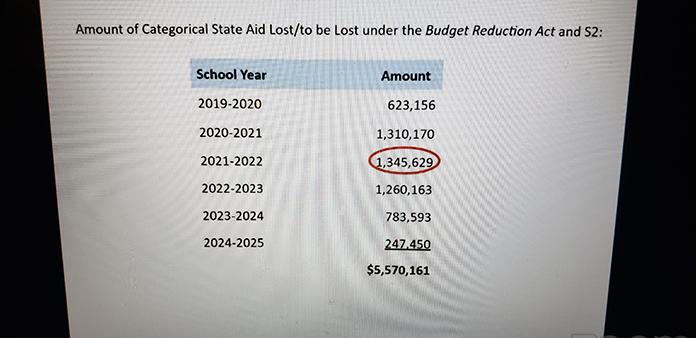

He said this would be “the third consecutive year in which our district to lose state aid, losing just short of $3.3 million so far and standing to lose another $2.3 million by the time all is said and done.”

DeGeorge blamed the state’s S-2 spending formula which has hurt several school districts in Ocean County by reducing their state aid funding.

“The state funding formula does not favor our district. The formula gives credit to only 15% of the actual 26% of students who are classified as special needs. That fact alone significantly skews what is known as the adequacy budget making it virtually impossible for this district to receive the appropriate amount of state aid. We have met with local legislators and are doing everything we can to stop the bleeding,” DeGeorge said.

“The total budget for our district has three main components,” he explained to the public. “The first is the general fund or operating budget. Just about everything happens there. The second is the special revenue or grants budget where we account for federal and local grants and the third is the debt service budget which accounts for the repayment of our bond debt.”

DeGeorge said the operating budget is increasing at only .29% from the current year’s budget. “Which is remarkable given the fact the great job our administrative team, budget managers and the Board has done to resolve this loss of state aid.”

He noted the grants budget is increasing by almost 30% due to the new ESSER II federal grant and the debt service budget is decreasing. “This time by almost two and a quarter percent.”

Focusing on revenue in the operating budget DeGeorge said, “the property tax levy which accounts for 70.1% of total operating budget revenue…is increasing 2.6%.”

DeGeorge said with state aid decreasing over $1.3 million next year, the actual amount becomes known to us only at the very end of the school year. “It presents a cash flow challenge for us all year long. The fund balance, known as excess surplus, is 30% higher. That is based on the fact that the district was closed at the end of the last 2019-20 school year. We are just following the rules when it comes to unspent funds in a given school year. We are using these funds to purchase curriculum and to remain compliant with the New Jersey student earning standards.”

He added “we are taking the statutory 2% increase in addition only because we desperately need to do so. We are using the remaining $300,000 from unused levy from previous years. If we do not use it in this year’s budget. It is lost forever. The increase on the operating budget portion of the levy is 2.6%. However when we factor in 2.72% decrease in the debt service portion of the levy, we get a combined net increase of 2.8 %.”

As to the school district’s reserve accounts DeGeorge said the school district has two reserve accounts – a capital account and maintenance reserve account. “Over the past several years this Board has managed to position a portion of the district’s fund balance and equity in these reserve accounts to take on health and safety related projects which are on our long-range facilities plan.”

DeGeorge said next year the district would be replacing an old outdated fire alarm system and the access systems around school buildings.

As to the spending plan side of the budget he said the increase is due in small part to projected increases in compensation as well as an increase in cost for substitute teachers. DeGeorge also noted increases in special education program costs.

“This is a very solid budget,” DeGeorge said in conclusion.

Superintendent Vanessa Clark called the budget “balanced and supports the students of our district.”

The Board went on to vote and approve the budget’s introduction. Board member Ed Scanlon said he was voting yes to the tentative budget “with the understanding it is a work in progress.”

Board member Regina Discenza cast the only no vote. “No because this budget is too harsh on the taxpayers. The property tax levy has now gone beyond $50 million. It is just too high.”