COLTS NECK – A financial counselor with the United States Army and major in the U.S. Army Reserves from Monmouth County has admitted to defrauding Gold Star families and more, officials said.

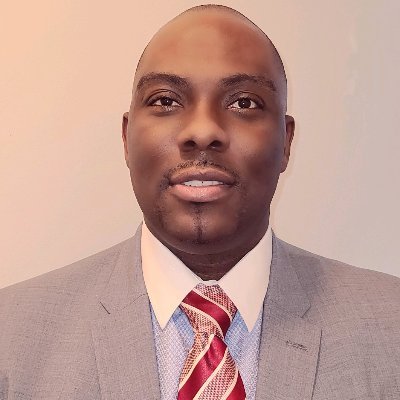

Caz Craffy, aka “Carz Craffey,” 41, of Colts Neck, pleaded guilty to the indictment filed against him, which charged six counts of wire fraud and one count each of securities fraud, making false statements in a loan application, committing acts affecting a personal financial interest, and making false statements to a federal agency.

“When a member of the Armed Services dies during active duty, his or her surviving beneficiary, now a member of a Gold Star family, is entitled to a $100,000 payment and the servicemember’s life insurance of up to $400,000. These payments are disbursed to the beneficiary in a matter of weeks or months following the servicemember’s death. To assist the beneficiaries in this time of need, the military provides a number of services to the servicemember’s family, including the assistance of a financial counselor,” officials stated.

Craffy was a civilian employee of the U.S. Army, working as a financial counselor with the Casualty Assistance Office, from November 2017 to January 2023. He was also a major in the U.S. Army Reserves, where he has been enlisted since 2003.

Craffy was responsible for providing general financial education to the surviving beneficiaries, and prohibited from offering any personal opinions. In addition, he was not permitted to participate personally in any government matter in which he had an outside financial interest.

Craffy simultaneously maintained outside employment with two separate financial investment firms without telling the Army, officials said.

Craffy targeted Gold Star families and other military families and encouraged them to invest their survivor benefits in investment accounts that he managed and were his private employment.

According to officials, many Gold Star families mistakenly believed that Craffy’s management of their money was done on behalf of and with the Army’s authorization.

From May 2018 to November 2022, Craffy obtained more than $9.9 million from Gold Star families to invest in accounts managed by Craffy in his private capacity. He would repeatedly execute trades, often without the family’s authorization. These unauthorized trades earned Craffy high commissions, officials said.

Craffy’s scheme lost more than $3.7 million of Gold Star family accounts, while Craffy personally earned more than $1.4 million in commissions.

“Craffy disgraced his entrusted position to care for our nation’s military families when he allegedly took advantage of them during a vulnerable time of grief,” Homeland Security Investigations Newark acting Special Agent in Charge William S. Walker said. “No family, especially our Gold Star families, should have to face further heartache after a loved one’s death by having their financial security ripped out from under them by fraudsters.”

Craffy faces up to 20 years in prison on wire fraud and securities fraud charges, up to two years for submitting a false statement on a loan application, five years for each charge of acts affecting a personal interest and false statements to a federal agent.

All counts but the securities fraud count are also punishable by a maximum fine of either $250,000 or twice the gain or loss from the offense, whichever is greatest. The securities fraud count is punishable by a maximum fine of either $5 million or twice the gain or loss from the offense, whichever is greatest. Sentencing is scheduled for August 21.

The U.S. Securities and Exchange Commission (SEC) has a pending civil complaint against Craffy based on the same and additional conduct. Craffy has been permanently prohibited from association with any member of the Financial Industry Regulatory Authority Inc. (FINRA).

U.S. Attorney Philip R. Sellinger credited special agents of the Department of the Army Criminal Investigation Division, under the direction of Special Agent in Charge Kirch; special agents of DCIS, under the direction of Principal Deputy Director Ives; special agents of the FBI, under the direction of Special Agent in Charge Dennehy; and special agents of Homeland Security Investigations Newark, under the direction of Acting Special Agent in Charge Walker, with the investigation leading to the indictment. He also expressed appreciation for the Securities and Exchange Commission, under the direction of Gurbir S. Grewal, Director, Division of Enforcement, and FINRA, under the direction of Head of Enforcement Bill St. Louis.